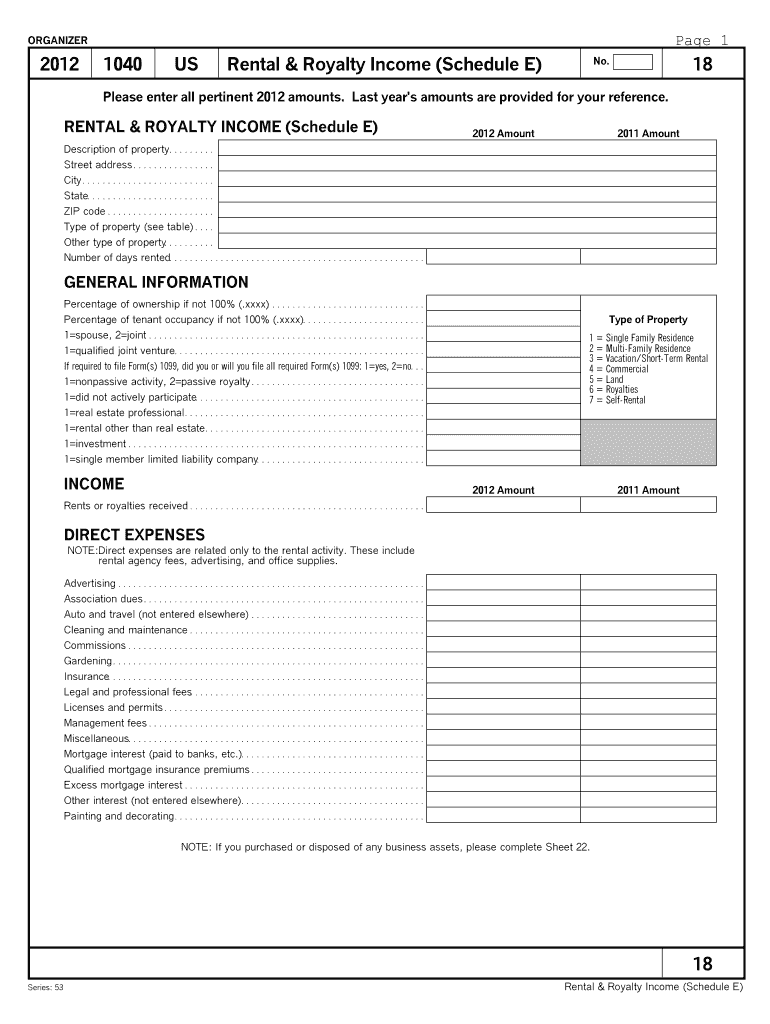

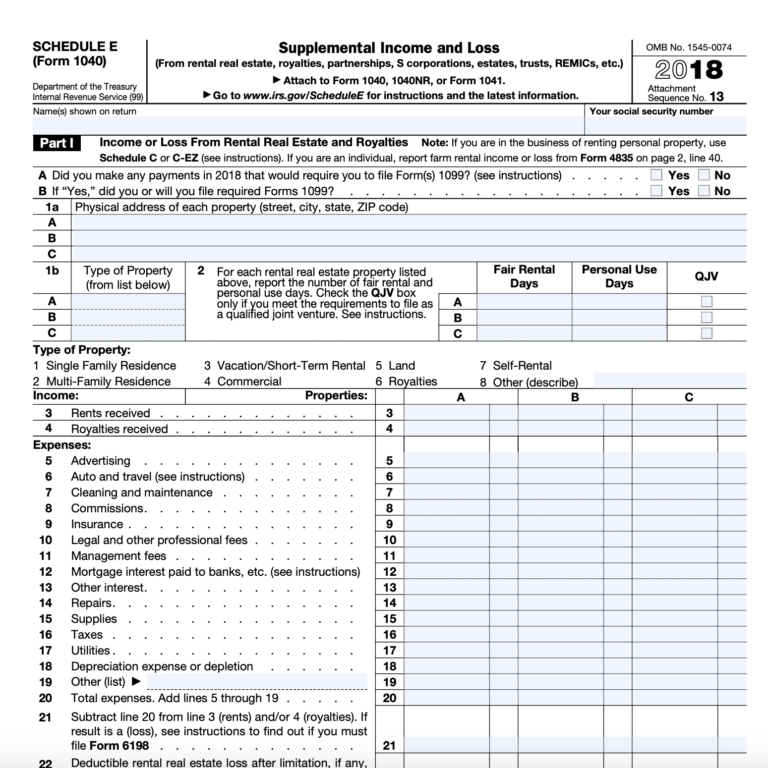

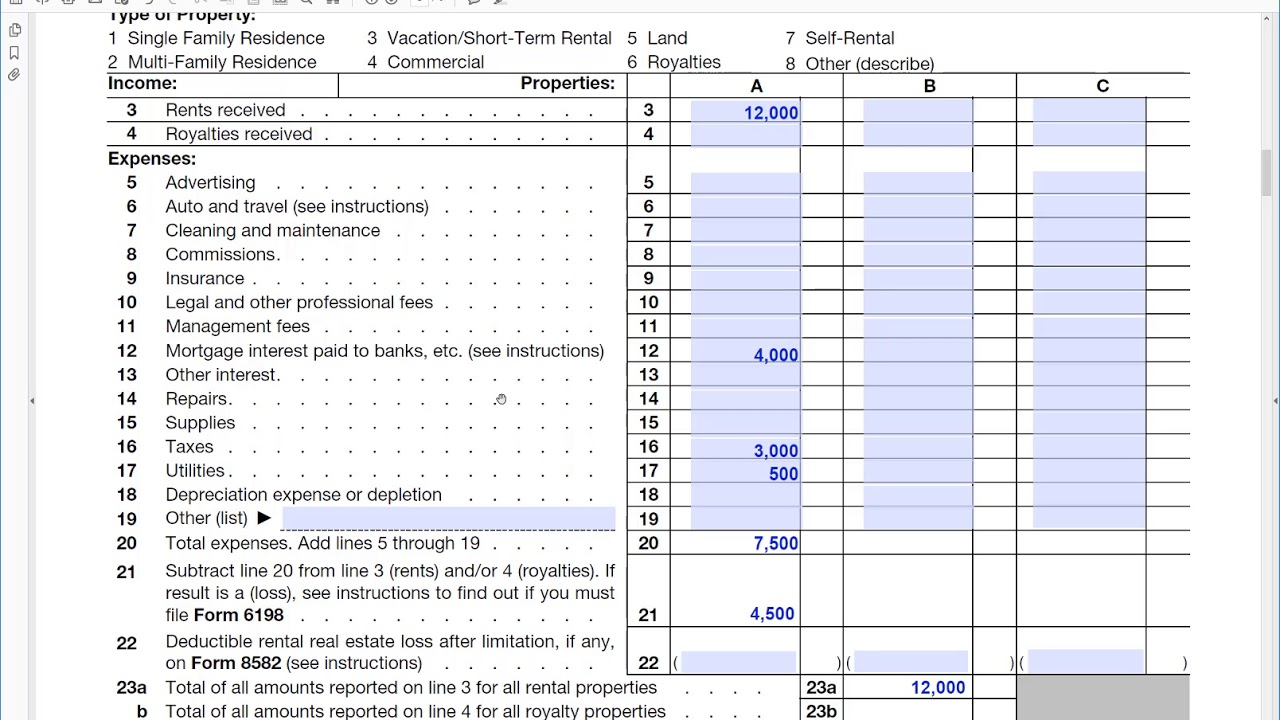

Schedule E Rental Income Worksheet - Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Kind of property street address city, state & zip code. The seller’s calculations must be. Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on.

Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Kind of property street address city, state & zip code. The seller’s calculations must be. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024?

Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. The seller’s calculations must be. Kind of property street address city, state & zip code. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e;

Schedule E Rental Worksheet Excel

Kind of property street address city, state & zip code. Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Use schedule e (form 1040) to report income or loss.

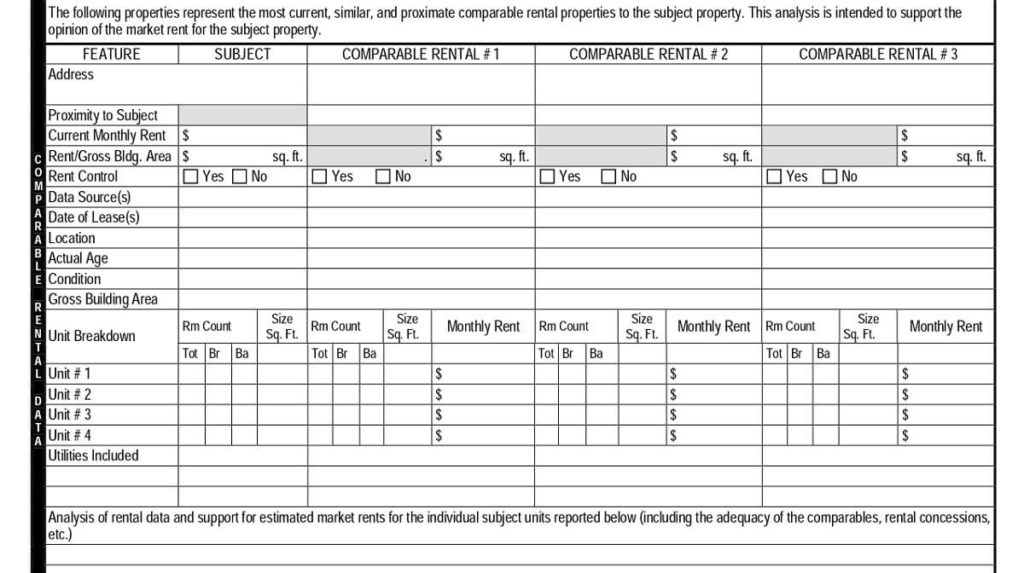

Schedule E Calculate Rental

Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Kind of property street address city, state & zip code. The seller’s calculations must be. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Information about.

Schedule E Worksheet For Rental Property

Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Kind of property street address city, state & zip code. Rental property or royalty income worksheet (schedule.

Schedule E Rental Worksheet Excel

The seller’s calculations must be. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Kind of property street address city, state & zip code. Rental property or royalty income worksheet.

What Is Schedule E Here S An Overview For Your Rental 2021 Tax Forms

Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; The seller’s calculations must be. Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Kind of property street address city, state & zip code. Information about schedule e (form.

Schedule E Rental Worksheet Excel 2021

The seller’s calculations must be. Information about schedule e (form 1040), supplemental income and loss, including recent updates, related forms, and instructions on. Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Rental property or royalty income worksheet (schedule e) did any of the above properties have.

Rental Schedule E

Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? The seller’s calculations must be. Use schedule e (form 1040) to report income or loss from rental real estate, royalties,.

Schedule E Rental Worksheet Excel

The seller’s calculations must be. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Kind of property street address city, state & zip code. Rental property or royalty income worksheet (schedule e) did any of the above properties have personal use in 2024? Use schedule e (form 1040).

Schedule E Calculation Worksheet

Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. Kind of property street address city, state & zip code. The seller’s calculations must be. Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Rental property.

Free IRS Tax Form 1040 Schedule E Template Google Sheets & Excel

Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. The seller’s calculations must be. Rental property or royalty income worksheet (schedule e) did any of the.

Information About Schedule E (Form 1040), Supplemental Income And Loss, Including Recent Updates, Related Forms, And Instructions On.

Form 92 is a tool to help the seller calculate and document the calculation of net rental income from schedule e; Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual. The seller’s calculations must be. Kind of property street address city, state & zip code.