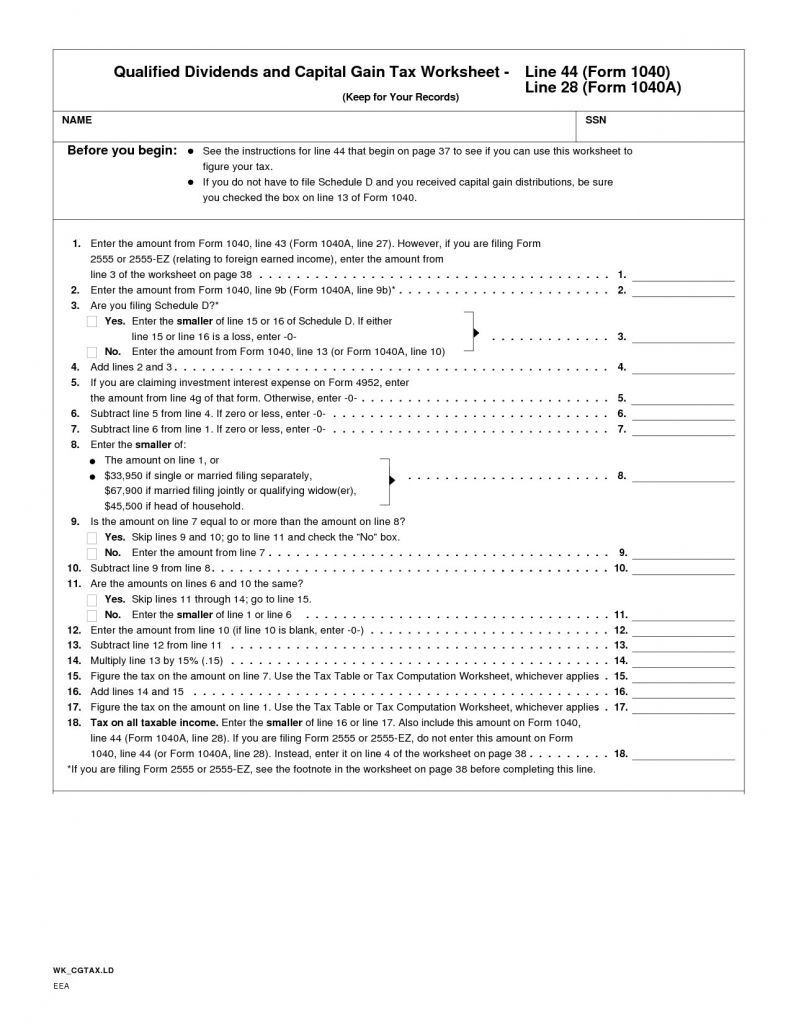

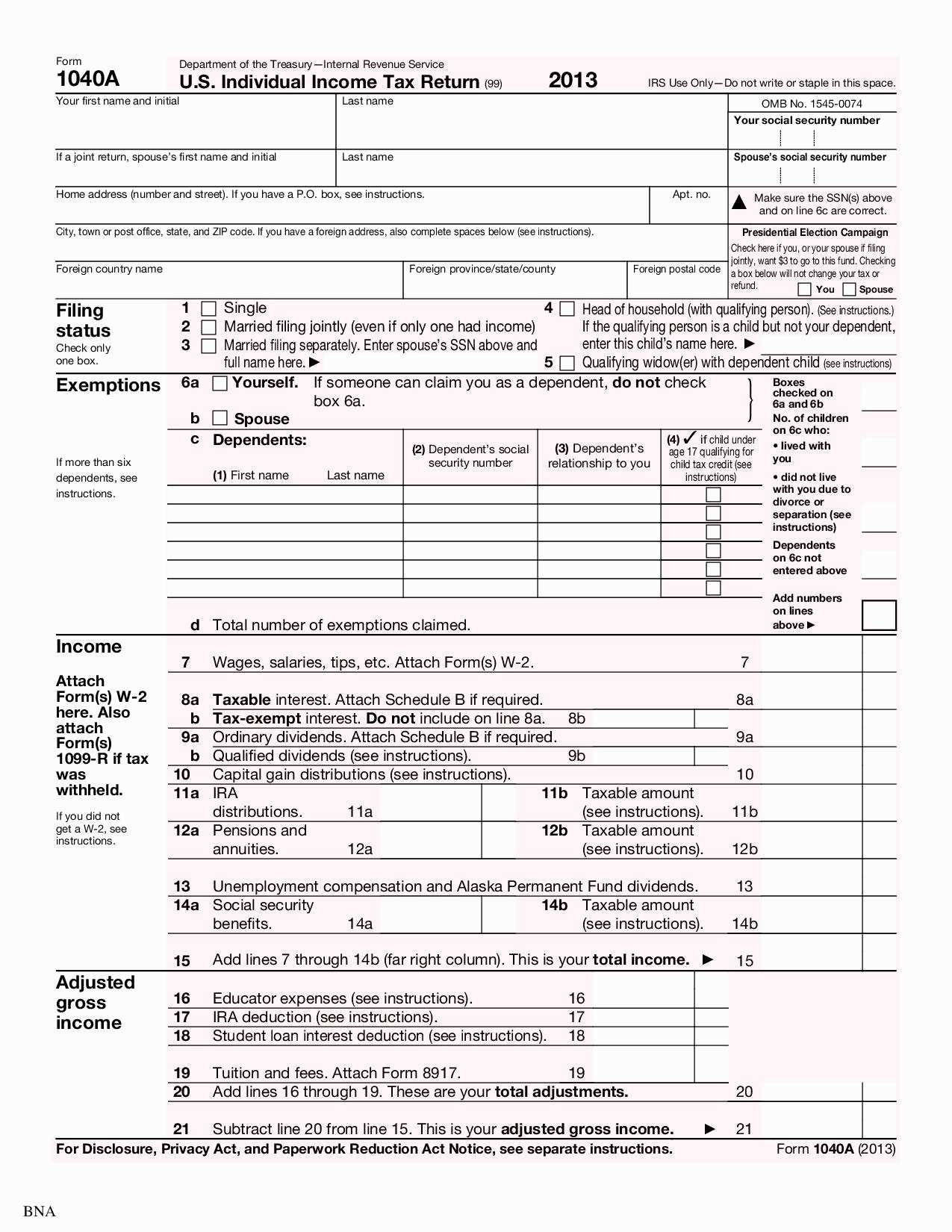

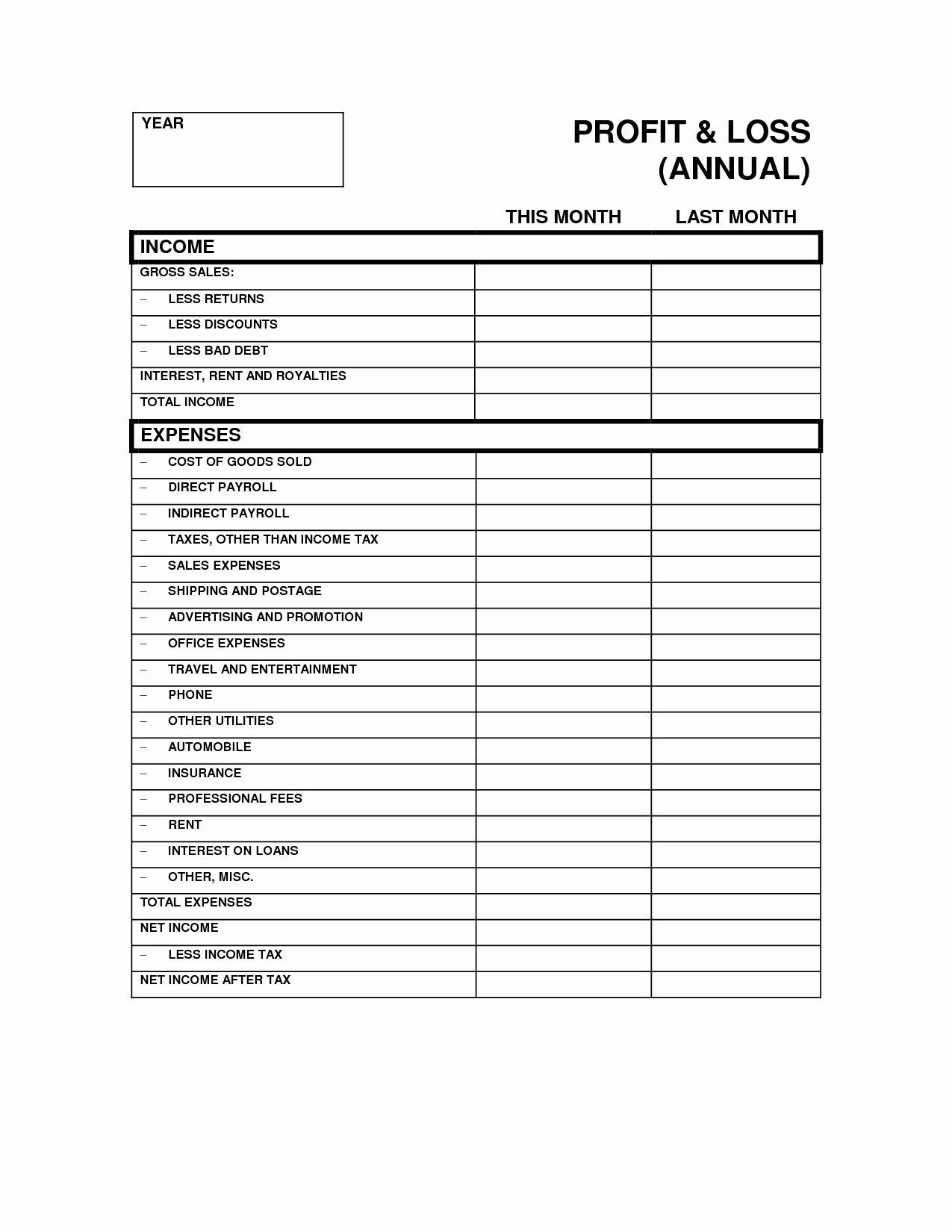

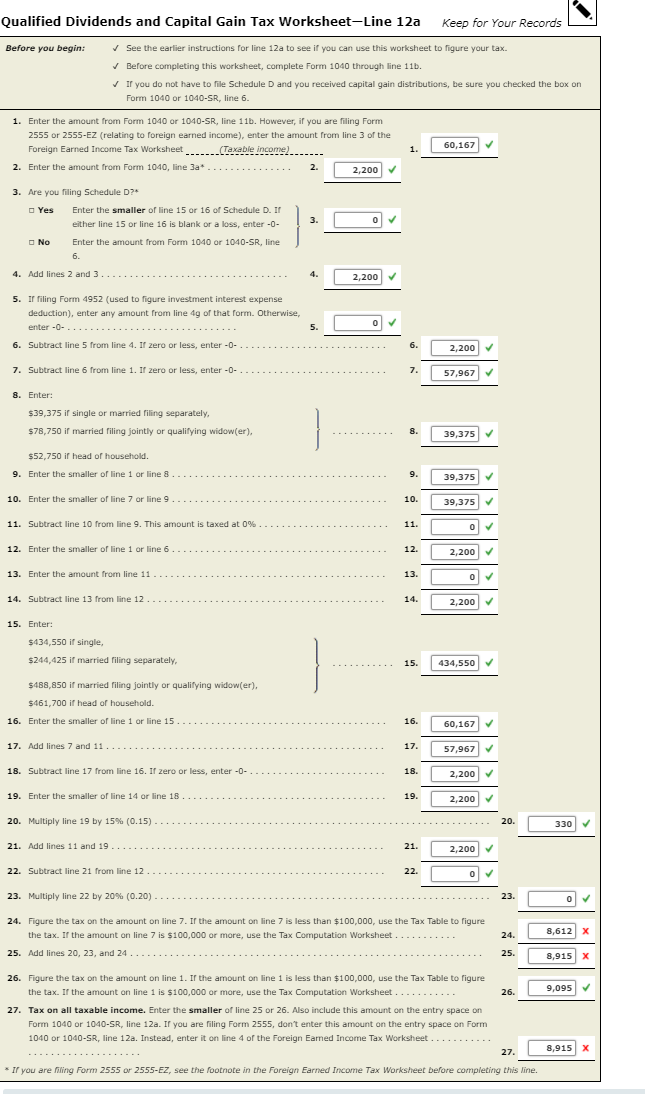

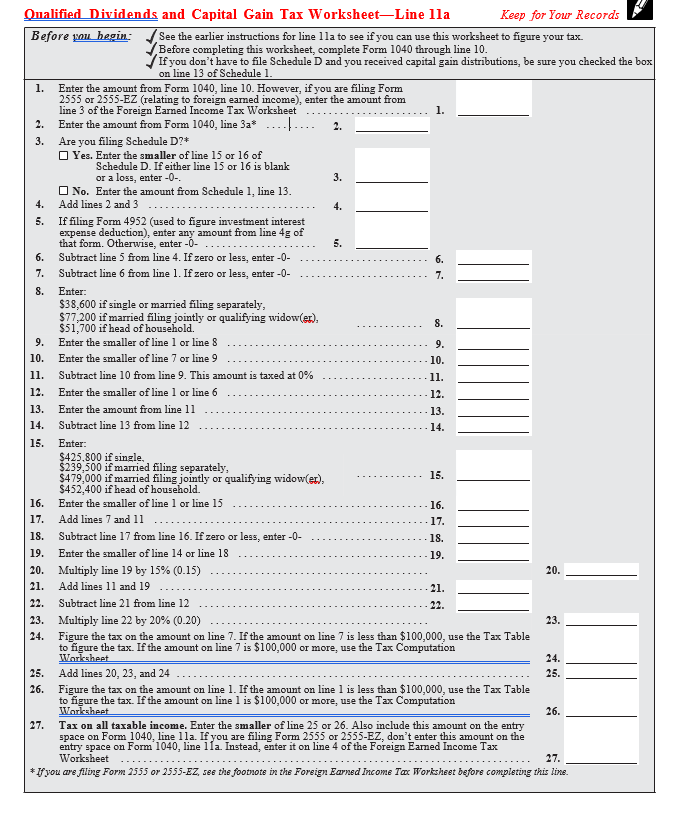

Qualified Dividends And Capital Gains Worksheet Line 16 - The text for our sermon can be found in an obscure worksheet in the form 1040. V/ see the instructions for line 16 in the instructions to see if you can use this. This worksheet calculates taxes owed on qualified dividends and capital gains,. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. Use 1 of the following methods to calculate the tax for line 16 of form 1040.

V/ see the instructions for line 16 in the instructions to see if you can use this. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. The text for our sermon can be found in an obscure worksheet in the form 1040. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. Use 1 of the following methods to calculate the tax for line 16 of form 1040. This worksheet calculates taxes owed on qualified dividends and capital gains,.

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. The text for our sermon can be found in an obscure worksheet in the form 1040. This worksheet calculates taxes owed on qualified dividends and capital gains,. V/ see the instructions for line 16 in the instructions to see if you can use this.

Qualified Dividends And Capital Gains Sheet

The text for our sermon can be found in an obscure worksheet in the form 1040. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. This worksheet calculates taxes owed on qualified dividends and capital gains,. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Did you dispose of.

Qualified Dividends and Capital Gain Tax Worksheet in Excel

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. The text for our sermon can be found in an obscure worksheet in the form 1040. Use 1 of the following methods to calculate the tax for line 16 of form 1040. This worksheet calculates taxes owed on qualified dividends and capital gains,. Don’t use.

Qualified Dividends And Capital Gain Tax Worksheet Instructi

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. This worksheet calculates taxes owed on qualified dividends and capital gains,. Use 1 of the following methods to calculate the tax for line 16 of form 1040. V/ see the instructions for.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

This worksheet calculates taxes owed on qualified dividends and capital gains,. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. V/ see the instructions for line 16 in the instructions to see if you can use this. The text for.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Use 1 of the following methods to calculate the tax for line 16 of form 1040. V/ see the instructions for line 16 in the instructions to see if you can use this. The text for our sermon can be found in an obscure worksheet.

39 1040 qualified dividends and capital gains worksheet Worksheet Master

V/ see the instructions for line 16 in the instructions to see if you can use this. This worksheet calculates taxes owed on qualified dividends and capital gains,. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Use 1 of the.

Qualified Dividends And Capital Gains Tax Worksheet Printable

Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. Use 1 of the following methods to calculate the tax for line 16 of form 1040. This worksheet calculates taxes owed on qualified dividends and capital gains,. The text for our sermon can be found in an obscure worksheet in the form 1040. Did you dispose of.

Qualified Dividends And Capital Gain Tax Worksheet Calculato

V/ see the instructions for line 16 in the instructions to see if you can use this. The text for our sermon can be found in an obscure worksheet in the form 1040. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. Use 1 of the following methods to calculate the tax for line 16 of.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

Use 1 of the following methods to calculate the tax for line 16 of form 1040. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. The text for our sermon can be found in an obscure worksheet in the form 1040. This worksheet calculates taxes owed on qualified dividends and capital gains,. V/ see.

Qualified Dividends And Capital Gains Worksheet 2022

Don’t use the qualified dividends and capital gain tax worksheet or this worksheet. This worksheet calculates taxes owed on qualified dividends and capital gains,. The text for our sermon can be found in an obscure worksheet in the form 1040. Use 1 of the following methods to calculate the tax for line 16 of form 1040. V/ see the instructions.

Did You Dispose Of Any Investment(S) In A Qualified Opportunity Fund During The Tax Year?.

Use 1 of the following methods to calculate the tax for line 16 of form 1040. This worksheet calculates taxes owed on qualified dividends and capital gains,. The text for our sermon can be found in an obscure worksheet in the form 1040. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet.