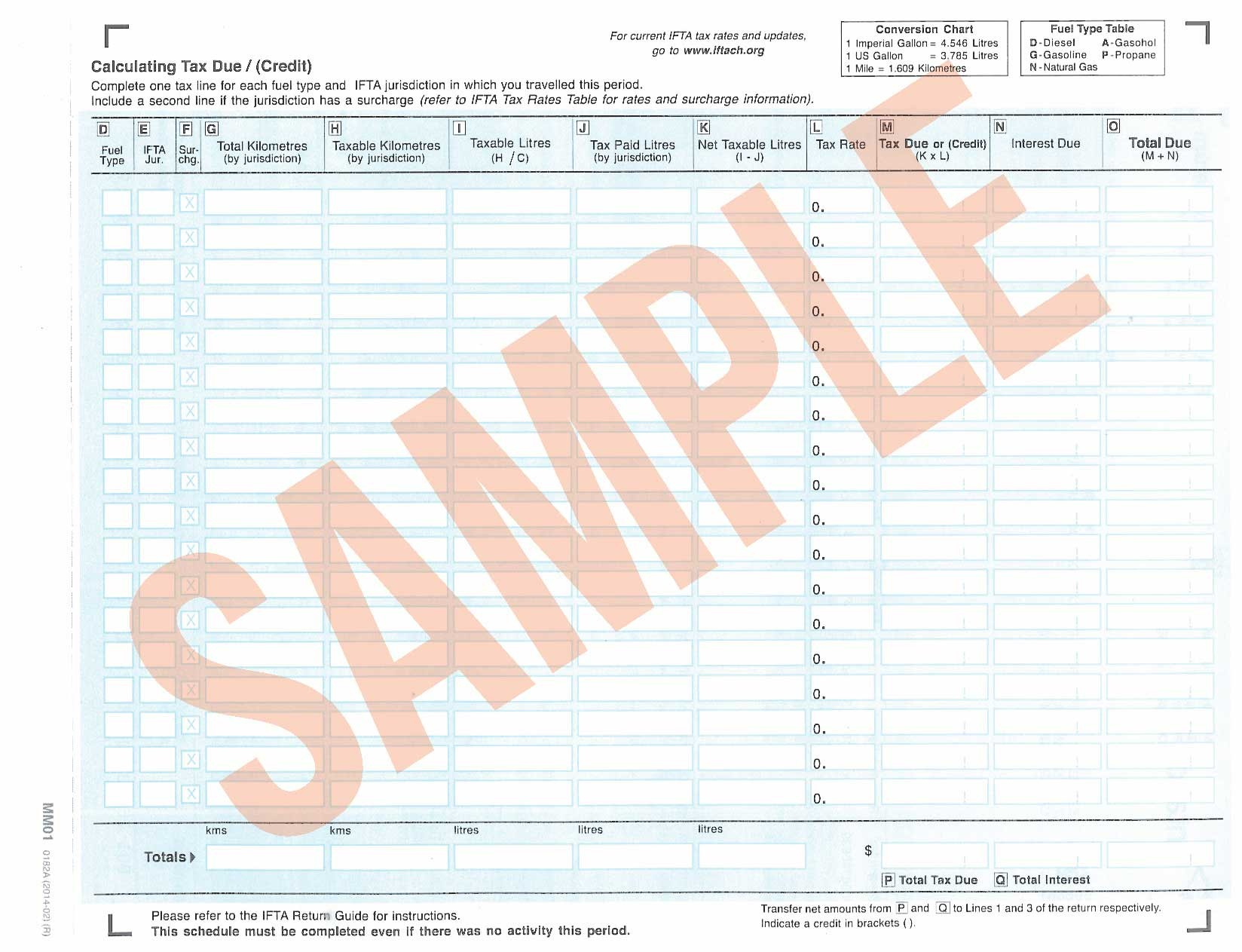

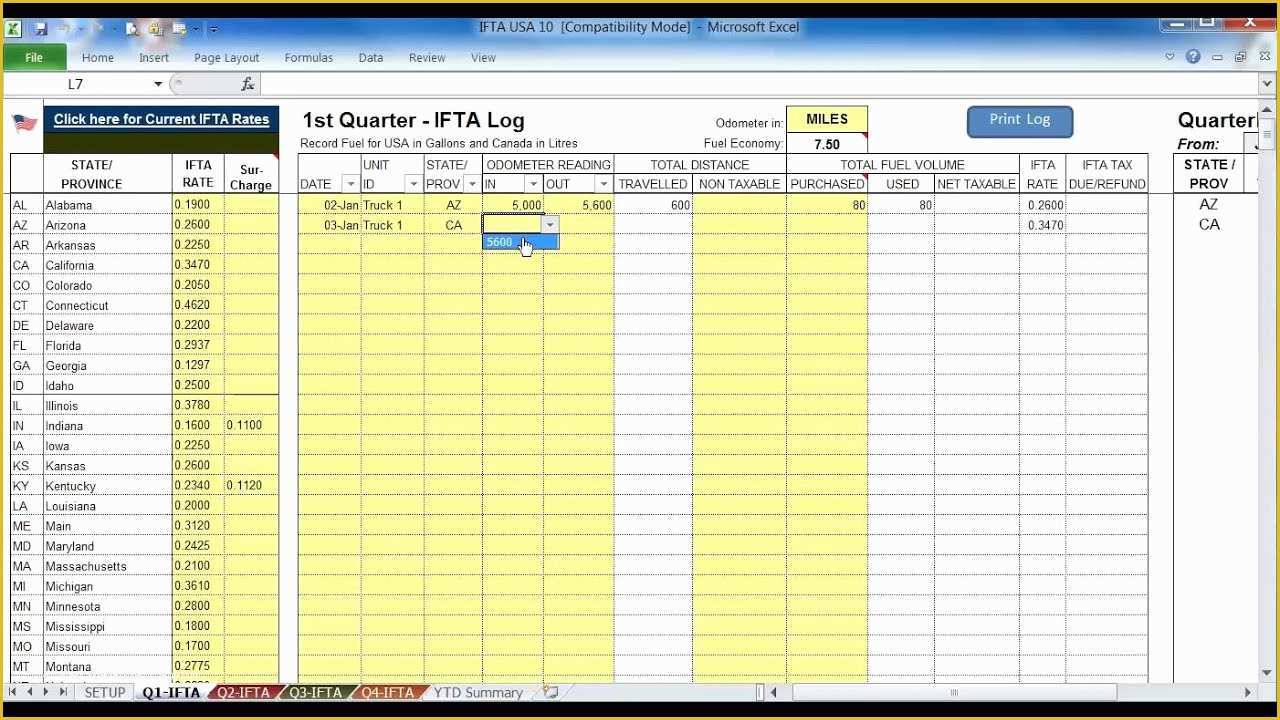

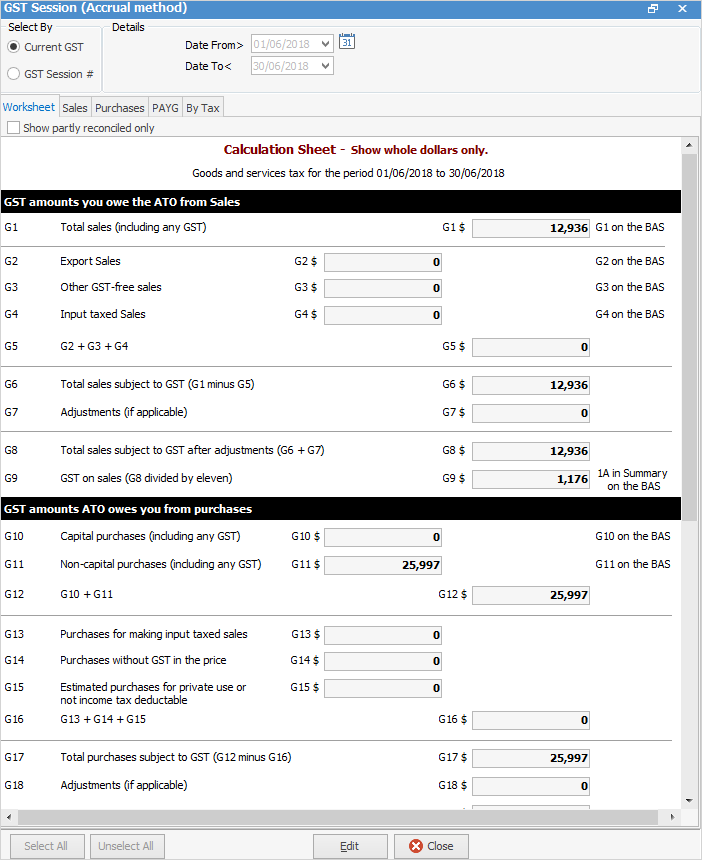

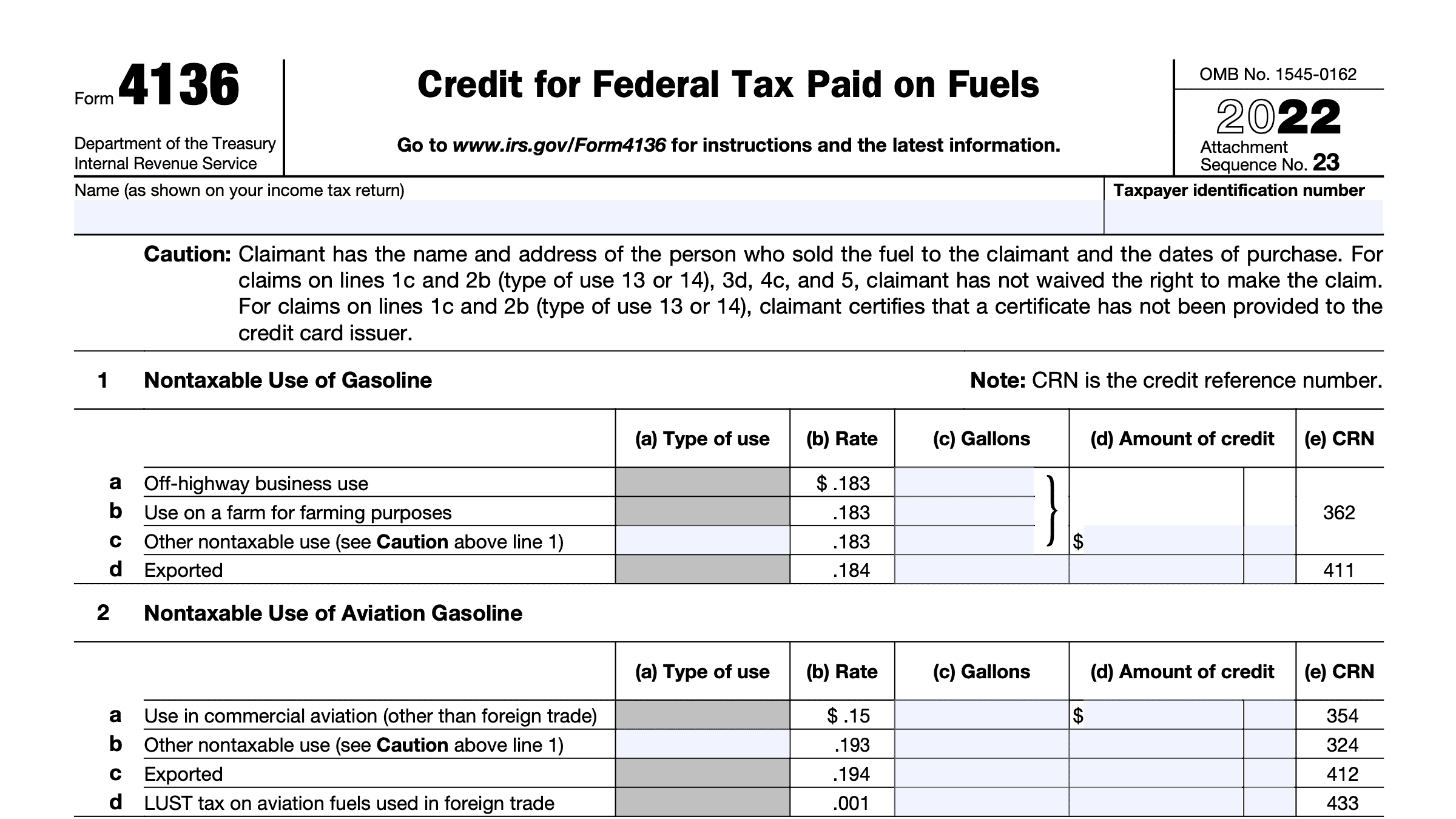

Fuel Tax Credits Calculation Worksheet - Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. Use the rate that applied when you acquired the fuel. Work out how much fuel (liquid or gaseous) you acquired for each business activity. Work out your eligible quantities work out how much fuel (liquid. There are three steps to calculate your fuel tax credits using our worksheet step 1: You must be registered for gst and fuel. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet.

Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. You must be registered for gst and fuel. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. There are three steps to calculate your fuel tax credits using our worksheet step 1: Use the rate that applied when you acquired the fuel. Work out your eligible quantities work out how much fuel (liquid. Work out how much fuel (liquid or gaseous) you acquired for each business activity. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,.

Work out your eligible quantities work out how much fuel (liquid. Work out how much fuel (liquid or gaseous) you acquired for each business activity. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. There are three steps to calculate your fuel tax credits using our worksheet step 1: Use the rate that applied when you acquired the fuel. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. You must be registered for gst and fuel.

Fuel Tax Credit Calculation Worksheet

Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Work out your eligible quantities work out how much fuel (liquid. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Work out how much fuel (liquid or gaseous) you acquired for each business activity. Fuel.

Fuel Tax Credit Calculation Worksheet

There are three steps to calculate your fuel tax credits using our worksheet step 1: Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Work out your eligible quantities work out how much fuel (liquid. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. Work out how.

Fuel Tax Credits 2024 Jacqui Nissie

Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. Work out your eligible quantities work out how much fuel (liquid. Use this worksheet to help you calculate your fuel tax credits.

Fuel Tax Credit Calculation Sheet

To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. You must be registered for gst and fuel. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Fuel.

Fuel Tax Credit Calculation Worksheet

There are three steps to calculate your fuel tax credits using our worksheet step 1: Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Work out how much fuel (liquid or gaseous) you acquired for each business activity. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates..

Fuel Tax Credit Calculation Worksheet

Work out your eligible quantities work out how much fuel (liquid. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. You must be registered for gst and fuel. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. There are three.

Fuel Tax Credits Calculation Worksheet

You must be registered for gst and fuel. Work out your eligible quantities work out how much fuel (liquid. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes..

Fuel Tax Credits Calculation Worksheet

Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. Work out how much fuel (liquid or gaseous) you acquired for each business activity. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. Use the rate that applied when you acquired.

Fuel Tax Credits 2024 Pdf Vonni Susana

You must be registered for gst and fuel. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Fuel tax credit rates.

Fuel Tax Credits Calculation Worksheet

Work out your eligible quantities work out how much fuel (liquid. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,. Work out how much fuel (liquid or gaseous) you acquired for each business activity. There are three steps to calculate your fuel tax credits using our worksheet step 1: Use this worksheet.

Work Out How Much Fuel (Liquid Or Gaseous) You Acquired For Each Business Activity.

Work out your eligible quantities work out how much fuel (liquid. You must be registered for gst and fuel. Fuel tax credit rates for liquid fuels * a heavy vehicle is a vehicle with a gross vehicle mass (gvm) greater than 4.5 tonnes. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet.

There Are Three Steps To Calculate Your Fuel Tax Credits Using Our Worksheet Step 1:

Use the rate that applied when you acquired the fuel. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Accurately calculating fuel tax credits requires a thorough understanding of the applicable tax rates. To help you determine if you're qualified to claim any fuel tax credit (ftc) on form 4136,.