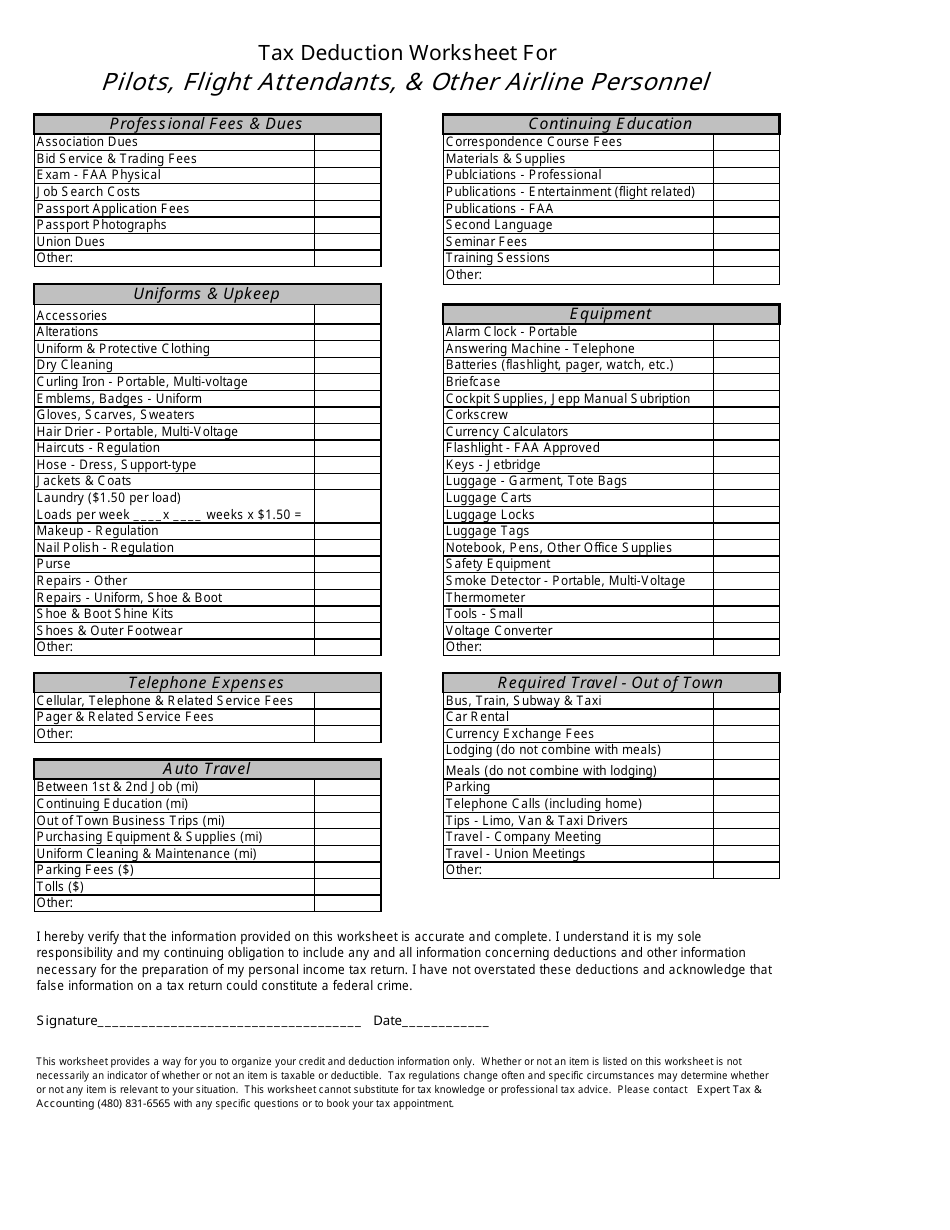

Flight Attendant Tax Deductions Worksheet - Dues paid to professional societies related to your. Airline flight keyexpenses crew personnel professional fees & dues: Flight attendant professional deductions receipts are not required for travel expenses under $75 if entered into your logbook, including item, date &. We will need the completed “flight deduction organizer”. If you live in al, ar, ca, hi, ny, mn or pa your state will allow flight deductions. If you live in al, ar, ca, hi, ny, mn or pa, your state will allow flight deductions. Enter amounts as year’s totals unless otherwise. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. There are two types of deductions for pilots and flight attendants. I understand this worksheet provides a way for me to organize my deduction information only.

There are two types of deductions for pilots and flight attendants. Enter amounts as year’s totals unless otherwise. We will need the completed “flight deduction organizer”. All expenses below must be specifically for business use and not reimbursed by employer. Airline flight keyexpenses crew personnel professional fees & dues: We will need the completed “flight deduction organizer”. I understand this worksheet provides a way for me to organize my deduction information only. Whether or not an item is listed on this worksheet is not. Dues paid to professional societies related to your. Flight attendant professional deductions receipts are not required for travel expenses under $75 if entered into your logbook, including item, date &.

Whether or not an item is listed on this worksheet is not. We will need the completed “flight deduction organizer”. Airline flight keyexpenses crew personnel professional fees & dues: If you live in al, ar, ca, hi, ny, mn or pa, your state will allow flight deductions. We will need the completed “flight deduction organizer”. I understand this worksheet provides a way for me to organize my deduction information only. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. There are two types of deductions for pilots and flight attendants. All expenses below must be specifically for business use and not reimbursed by employer. Flight attendant professional deductions receipts are not required for travel expenses under $75 if entered into your logbook, including item, date &.

Flight Attendant Tax Deductions Worksheet

We will need the completed “flight deduction organizer”. Dues paid to professional societies related to your. All expenses below must be specifically for business use and not reimbursed by employer. There are two types of deductions for pilots and flight attendants. Flight attendant professional deductions receipts are not required for travel expenses under $75 if entered into your logbook, including.

32 Flight Attendant Tax Deductions Worksheet Worksheet Database 0AE

We will need the completed “flight deduction organizer”. Airline flight keyexpenses crew personnel professional fees & dues: First is out of pocket expenses such as uniforms, cell phone, union dues, etc. There are two types of deductions for pilots and flight attendants. Dues paid to professional societies related to your.

Flight Attendant Tax Deductions Worksheet

If you live in al, ar, ca, hi, ny, mn or pa, your state will allow flight deductions. There are two types of deductions for pilots and flight attendants. Airline flight keyexpenses crew personnel professional fees & dues: I understand this worksheet provides a way for me to organize my deduction information only. Flight attendant professional deductions receipts are not.

Tax Deductions For Flight Attendants

I understand this worksheet provides a way for me to organize my deduction information only. All expenses below must be specifically for business use and not reimbursed by employer. If you live in al, ar, ca, hi, ny, mn or pa, your state will allow flight deductions. Enter amounts as year’s totals unless otherwise. There are two types of deductions.

Flight Attendant Tax Deductions Worksheet 128 Attendance She

Whether or not an item is listed on this worksheet is not. Flight attendant professional deductions receipts are not required for travel expenses under $75 if entered into your logbook, including item, date &. I understand this worksheet provides a way for me to organize my deduction information only. Enter amounts as year’s totals unless otherwise. First is out of.

32 Flight Attendant Tax Deductions Worksheet Worksheet Database 0AE

If you live in al, ar, ca, hi, ny, mn or pa your state will allow flight deductions. Flight attendant professional deductions receipts are not required for travel expenses under $75 if entered into your logbook, including item, date &. There are two types of deductions for pilots and flight attendants. We will need the completed “flight deduction organizer”. First.

Flight Attendant Tax Deductions Worksheet 128 Attendance She

There are two types of deductions for pilots and flight attendants. Whether or not an item is listed on this worksheet is not. Dues paid to professional societies related to your. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. We will need the completed “flight deduction organizer”.

Flight Attendant Tax Deductions Worksheet

Flight attendant professional deductions receipts are not required for travel expenses under $75 if entered into your logbook, including item, date &. All expenses below must be specifically for business use and not reimbursed by employer. Enter amounts as year’s totals unless otherwise. If you live in al, ar, ca, hi, ny, mn or pa your state will allow flight.

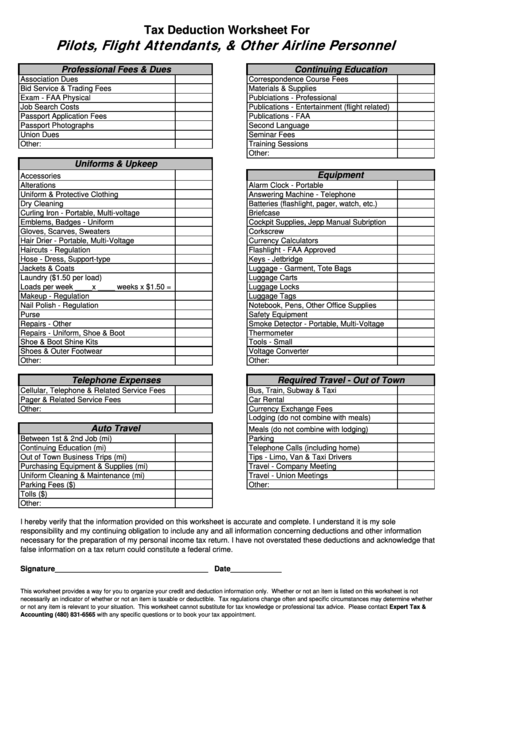

Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline

We will need the completed “flight deduction organizer”. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. Airline flight keyexpenses crew personnel professional fees & dues: I understand this worksheet provides a way for me to organize my deduction information only. Flight attendant professional deductions receipts are not required for travel expenses under $75 if.

Flight Attendant Tax Deductions 2023

We will need the completed “flight deduction organizer”. We will need the completed “flight deduction organizer”. Whether or not an item is listed on this worksheet is not. I understand this worksheet provides a way for me to organize my deduction information only. Dues paid to professional societies related to your.

We Will Need The Completed “Flight Deduction Organizer”.

Flight attendant professional deductions receipts are not required for travel expenses under $75 if entered into your logbook, including item, date &. I understand this worksheet provides a way for me to organize my deduction information only. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. We will need the completed “flight deduction organizer”.

Airline Flight Keyexpenses Crew Personnel Professional Fees & Dues:

Dues paid to professional societies related to your. If you live in al, ar, ca, hi, ny, mn or pa your state will allow flight deductions. There are two types of deductions for pilots and flight attendants. If you live in al, ar, ca, hi, ny, mn or pa, your state will allow flight deductions.

All Expenses Below Must Be Specifically For Business Use And Not Reimbursed By Employer.

Enter amounts as year’s totals unless otherwise. Whether or not an item is listed on this worksheet is not.