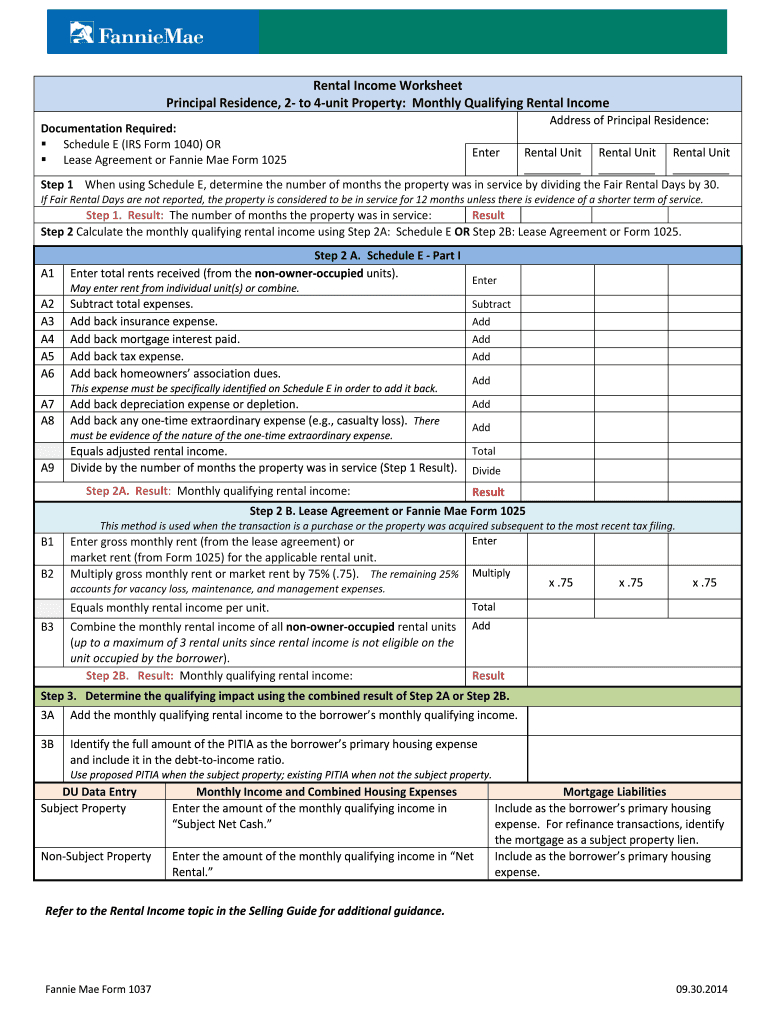

Essent Rental Income Worksheet - Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Schedule e or step 2b: Lease agreement or fannie mae form 1007 or form. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Calculate monthly qualifying rental income (loss) using step 2a: Ordinary income, net rental income: Use our excel calculators to easily total your.

Use our excel calculators to easily total your. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Calculate monthly qualifying rental income (loss) using step 2a: Ordinary income, net rental income: Schedule e or step 2b: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Lease agreement or fannie mae form 1007 or form.

Calculate monthly qualifying rental income (loss) using step 2a: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Schedule e or step 2b: Ordinary income, net rental income: Use our excel calculators to easily total your. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Lease agreement or fannie mae form 1007 or form.

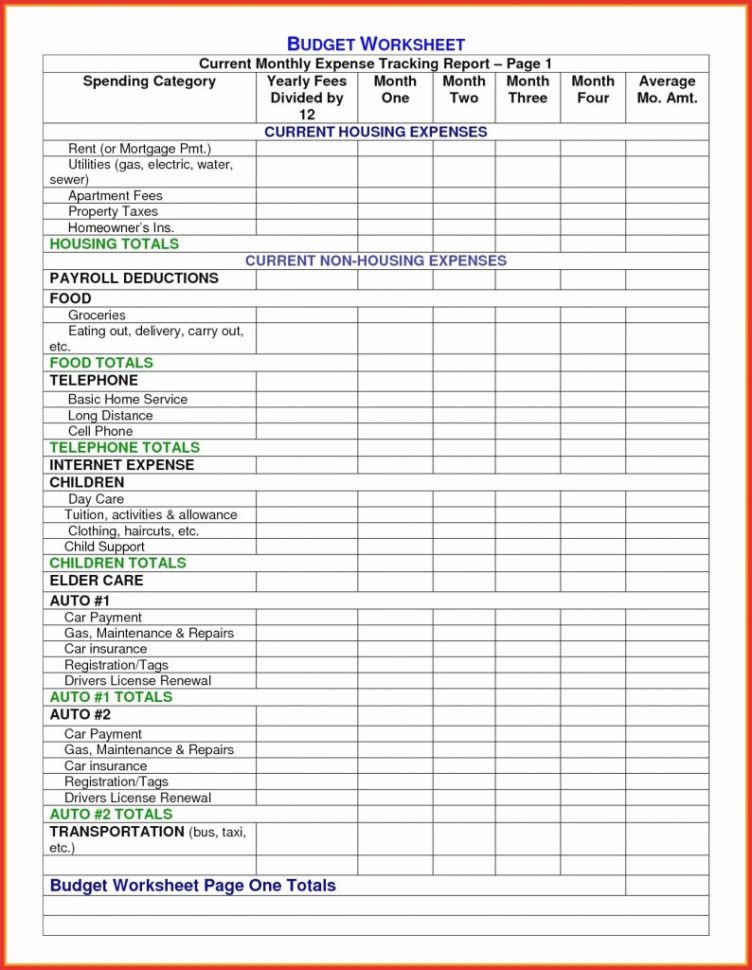

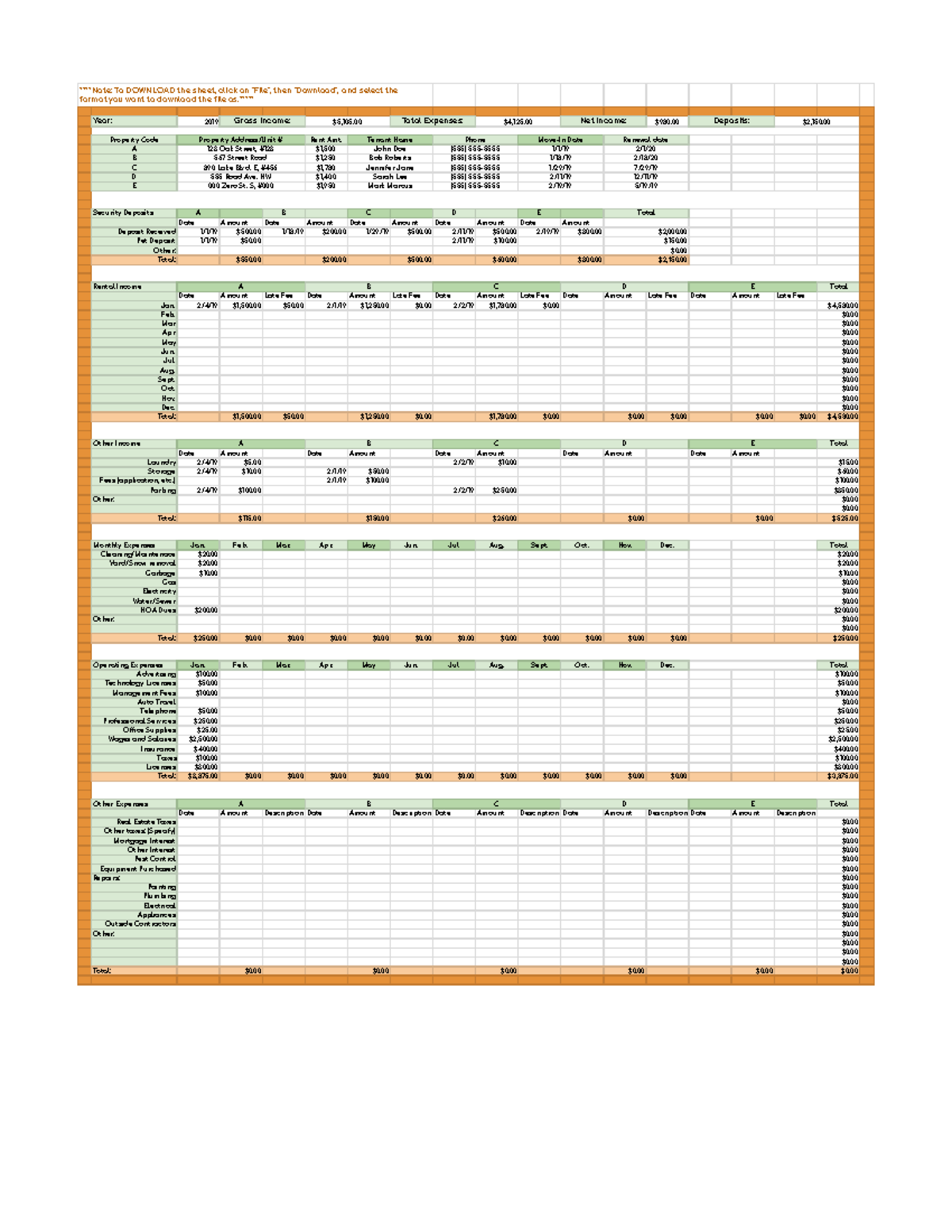

Rental and Expense Worksheet Google Sheets

Lease agreement or fannie mae form 1007 or form. Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Use our excel calculators to easily total your. Schedule e or step 2b: Ordinary income, net rental income:

Essent Rental Worksheet Printable Word Searches

Use our excel calculators to easily total your. Calculate monthly qualifying rental income (loss) using step 2a: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Lease agreement or fannie mae form 1007 or form. Schedule e or step 2b:

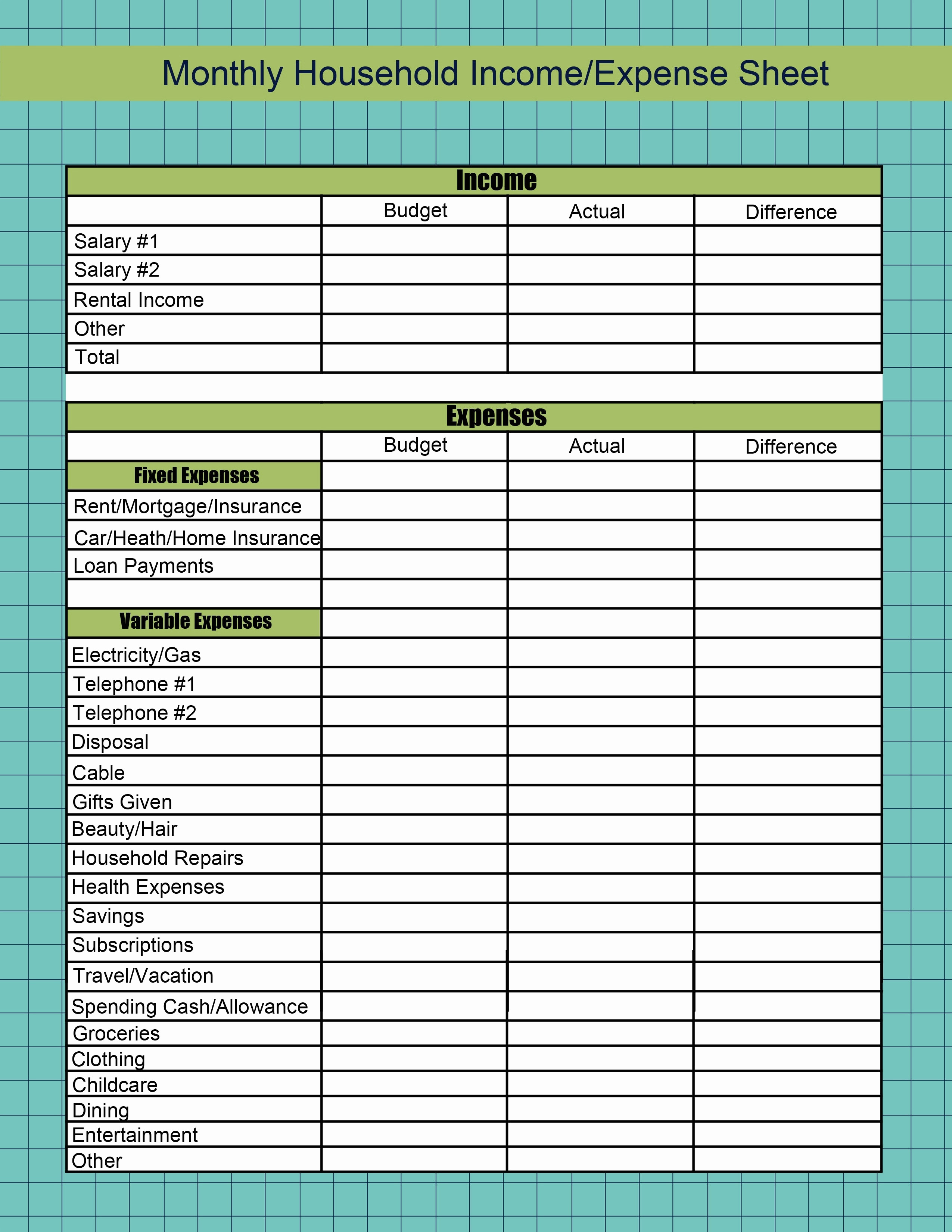

Rental Calculation Worksheet Fill Online, Printable

Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Schedule e or step 2b: Ordinary income, net rental income: Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Use our excel calculators to easily total your.

Fannie Mae Rental Calc Worksheet

Ordinary income, net rental income: Use our excel calculators to easily total your. Calculate monthly qualifying rental income (loss) using step 2a: Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property.

Rental Expense Worksheet Fill Online, Printable, Fillable

Ordinary income, net rental income: Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Calculate monthly qualifying rental income (loss) using step 2a: Use our excel calculators to easily total your.

Rental And Expense Spreadsheet —

Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Use our excel calculators to easily total your. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property..

Rental Schedule "E"asy Essent Mortgage Insurance

Use our excel calculators to easily total your. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Schedule e or step 2b: Ordinary income, net rental income:

Rental And Expense Worksheet Excel

Use our excel calculators to easily total your. Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Schedule e or step 2b: Income from part nerships, scorps, llcs, estates, or trusts can only be.

Rental and Expense Worksheet ****Note To DOWNLOAD the sheet

Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Schedule e or step 2b: Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains. Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Calculate monthly qualifying.

Rental And Expense Worksheet Pdf Fill and Sign Printable

Our income analysis tools are designed to help you evaluate qualifying income quickly and conveniently. Calculate monthly qualifying rental income (loss) using step 2a: Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender.

Our Income Analysis Tools Are Designed To Help You Evaluate Qualifying Income Quickly And Conveniently.

Use our excel calculators to easily total your. Assume 12 months of rental income/expenses for each tax year, unless other documentation (i.e., closing disclosure) proving date of property. Calculate monthly qualifying rental income (loss) using step 2a: Income from part nerships, scorps, llcs, estates, or trusts can only be considered if the lender obtains.

Schedule E Or Step 2B:

Ordinary income, net rental income: Lease agreement or fannie mae form 1007 or form.