Cfp Formula Sheet With Labels - Web cfp® board provided formulas (w/ bif explanations) effective annual return. Web tax table and formula materials are provided below to help you prepare for the cfp® exam. $250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. The tax tables provided for use. N = number of periods. The table below outlines the changes to. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Web new investment formula sheet for cfp exam. Web the net investment income, or the excess of modified adjusted gross income over the following threshold amounts:

$250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. The table below outlines the changes to. N = number of periods. Web cfp® board provided formulas (w/ bif explanations) effective annual return. Web new investment formula sheet for cfp exam. Web the net investment income, or the excess of modified adjusted gross income over the following threshold amounts: Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. The tax tables provided for use. Web tax table and formula materials are provided below to help you prepare for the cfp® exam.

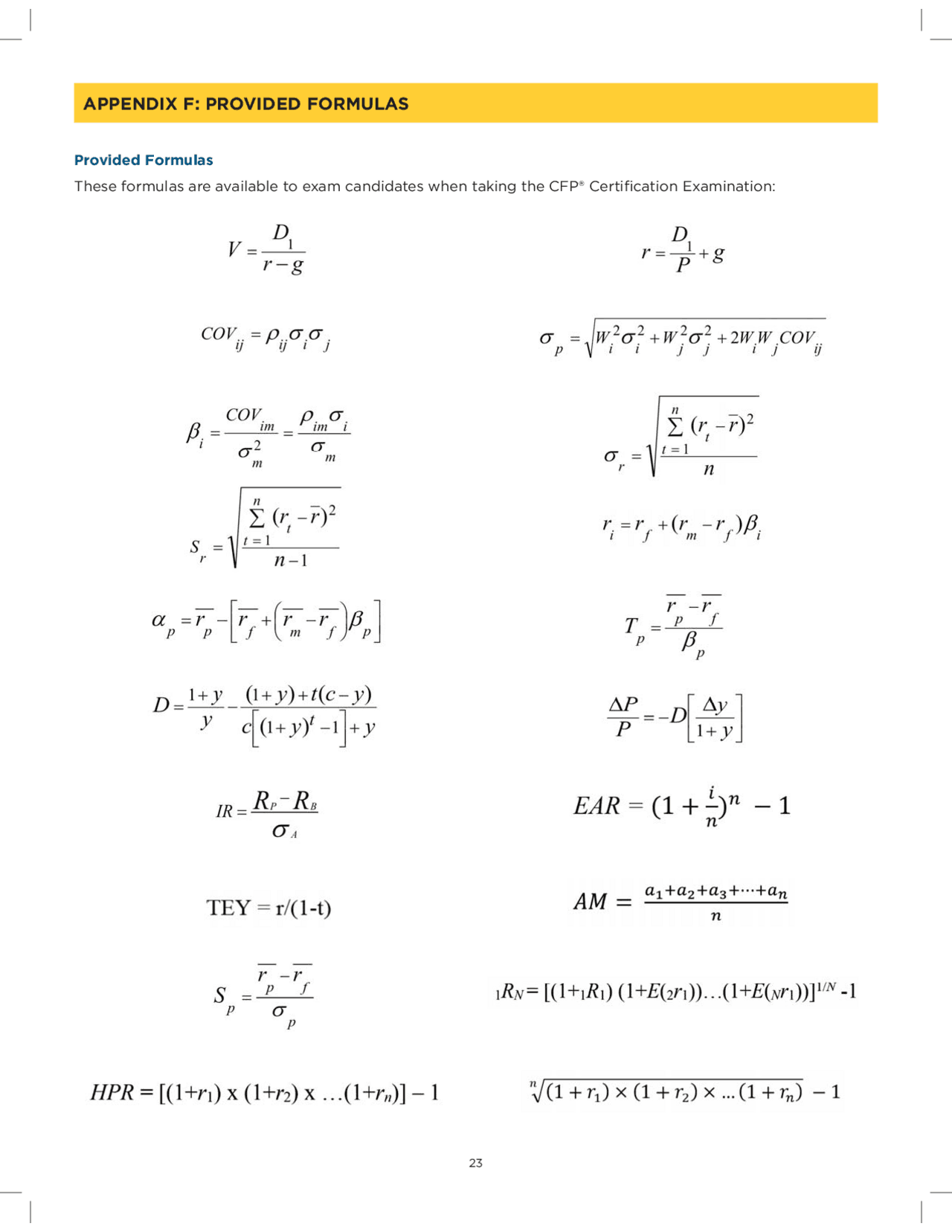

Web cfp® board provided formulas (w/ bif explanations) effective annual return. Web new investment formula sheet for cfp exam. The table below outlines the changes to. $250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. N = number of periods. Web tax table and formula materials are provided below to help you prepare for the cfp® exam. The tax tables provided for use. Web the net investment income, or the excess of modified adjusted gross income over the following threshold amounts: Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam.

Formula Sheet Youtube

The table below outlines the changes to. $250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Web new investment formula sheet for cfp exam. N = number of periods.

Formula sheet exam1 summer 2015 ECN 303 Studocu

Web new investment formula sheet for cfp exam. N = number of periods. Web the net investment income, or the excess of modified adjusted gross income over the following threshold amounts: $250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. The tax tables provided for use.

PHY 111 Equation Sheet

Web new investment formula sheet for cfp exam. N = number of periods. The tax tables provided for use. Web the net investment income, or the excess of modified adjusted gross income over the following threshold amounts: The table below outlines the changes to.

Formula sheet

N = number of periods. $250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. Web new investment formula sheet for cfp exam. Web cfp® board provided formulas (w/ bif explanations) effective annual return. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam.

CFP Course Highest Paying Global Certification in Financial Planning

Web the net investment income, or the excess of modified adjusted gross income over the following threshold amounts: $250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. Web tax table and formula materials are provided below to help you prepare for the cfp® exam. Web new investment formula sheet for cfp exam. Web cfp® board.

Diploma unopar г© bom by toryfgwq Issuu

$250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. The table below outlines the changes to. The tax tables provided for use. Web the net investment income, or the excess of modified adjusted gross income over the following threshold amounts: Web new investment formula sheet for cfp exam.

Formula Sheet Semester 1 2017 Corporate Finance I Corporate Finance

$250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. N = number of periods. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. The table below outlines the changes to. The tax tables provided for use.

CFP Presentation YouTube

N = number of periods. Web cfp® board provided formulas (w/ bif explanations) effective annual return. The tax tables provided for use. Web new investment formula sheet for cfp exam. $250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married.

CFP formula sheet Cheat Sheet Financial Accounting Docsity

N = number of periods. Web the net investment income, or the excess of modified adjusted gross income over the following threshold amounts: The table below outlines the changes to. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. The tax tables provided for use.

CFP Requirements CFP Exam & Education Requirements AdvisoryHQ

The table below outlines the changes to. Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Web cfp® board provided formulas (w/ bif explanations) effective annual return. $250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married. Web new investment formula sheet for cfp exam.

Web The Net Investment Income, Or The Excess Of Modified Adjusted Gross Income Over The Following Threshold Amounts:

Cfp board has recently updated its investment formulas sheet, which is provided to candidates taking the cfp exam. Web cfp® board provided formulas (w/ bif explanations) effective annual return. Web new investment formula sheet for cfp exam. $250,000 for married filing jointly or qualifying widow(er) with dependent child $125,000 for married.

The Table Below Outlines The Changes To.

Web tax table and formula materials are provided below to help you prepare for the cfp® exam. The tax tables provided for use. N = number of periods.