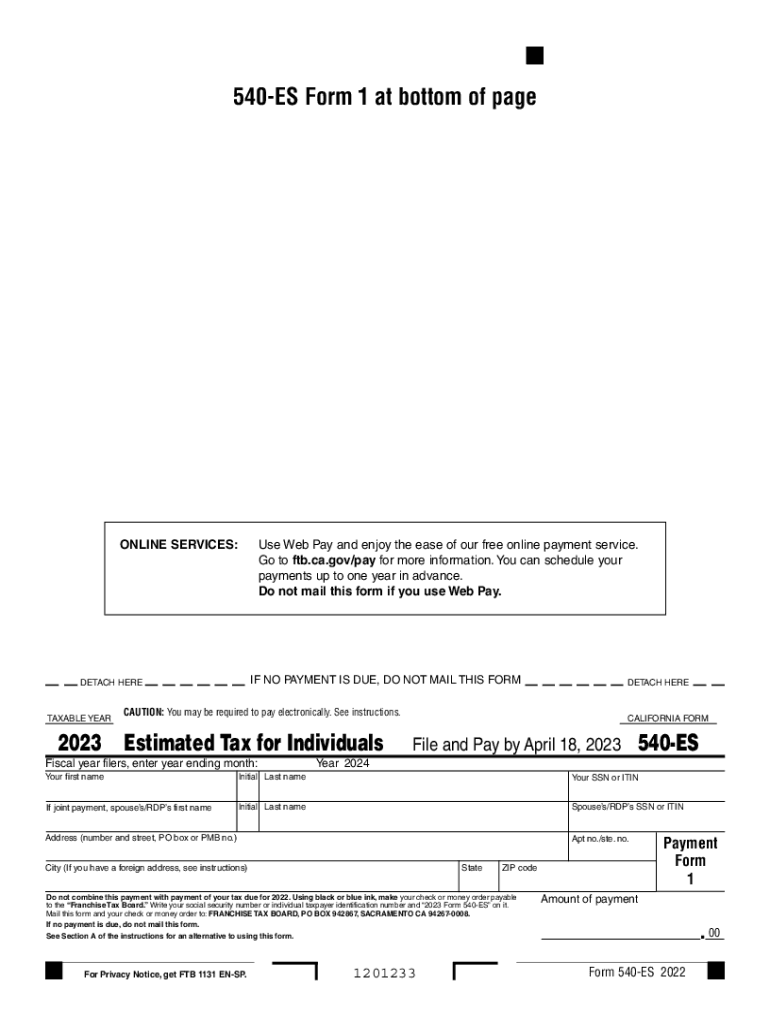

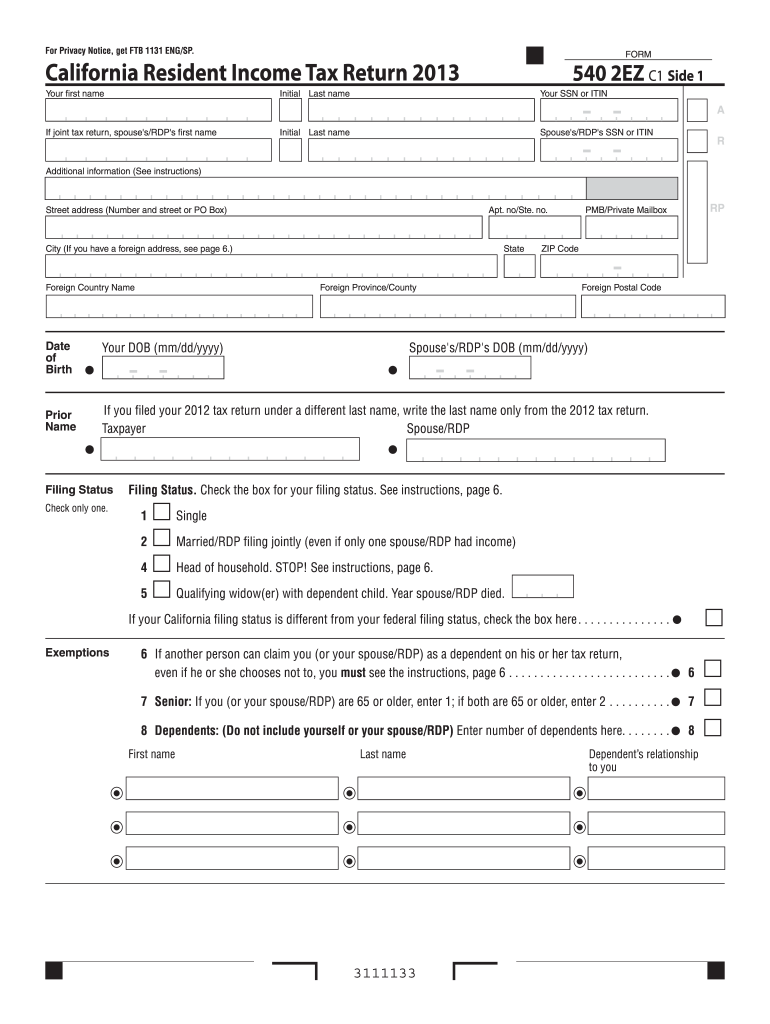

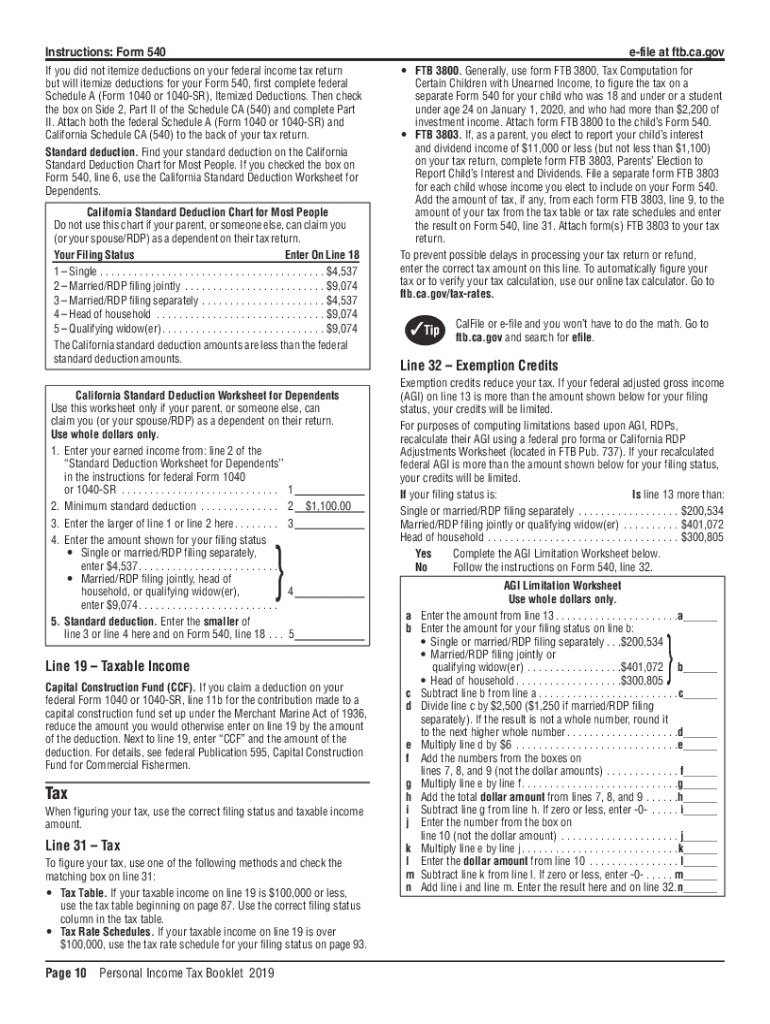

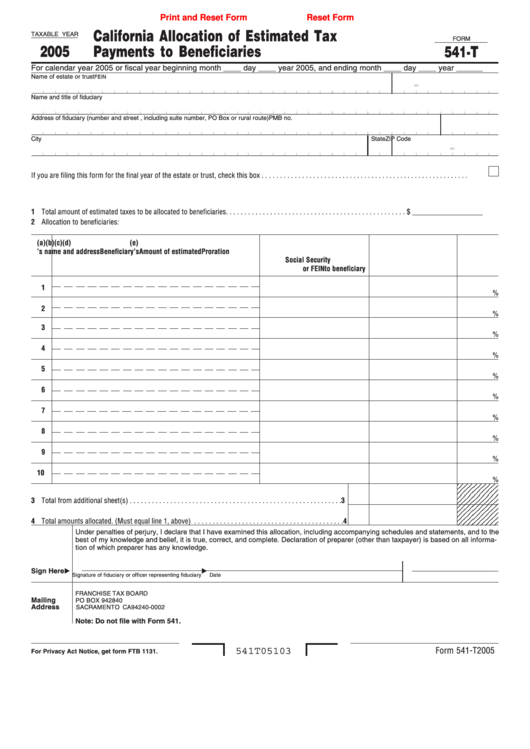

2022 California Estimated Tax Worksheet - Do not include dollar signs ($), commas (,), decimal points (.), or negative. Mail this form and your check or money. Estimated tax is used to pay. Use the 540 2ez tax tables on the tax calculator, tables, and rates page. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use 100% of the 2025 estimated total tax.

Use the 540 2ez tax tables on the tax calculator, tables, and rates page. Use 100% of the 2025 estimated total tax. Estimated tax is used to pay. Mail this form and your check or money. Do not include dollar signs ($), commas (,), decimal points (.), or negative. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Mail this form and your check or money. Do not include dollar signs ($), commas (,), decimal points (.), or negative. Use 100% of the 2025 estimated total tax. Estimated tax is used to pay. Use the 540 2ez tax tables on the tax calculator, tables, and rates page.

California Estimated Tax Worksheet 20232025 Form Fill Out and Sign

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use the 540 2ez tax tables on the tax calculator, tables, and rates page. Mail this form and your check or money. Do not include dollar signs ($), commas (,), decimal points (.), or negative. Estimated tax is used to.

2024 California Estimated Tax Worksheet Juli Saidee

Estimated tax is used to pay. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use the 540 2ez tax tables on the tax calculator, tables, and rates page. Use 100% of the 2025 estimated total tax. Mail this form and your check or money.

California Estimated Tax Payments 2024

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use 100% of the 2025 estimated total tax. Estimated tax is used to pay. Do not include dollar signs ($), commas (,), decimal points (.), or negative. Use the 540 2ez tax tables on the tax calculator, tables, and rates.

California Ftb Estimated Tax Payments 2024 Dorri Maible

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use 100% of the 2025 estimated total tax. Do not include dollar signs ($), commas (,), decimal points (.), or negative. Estimated tax is used to pay. Use the 540 2ez tax tables on the tax calculator, tables, and rates.

Estimated Tax Worksheet 2022

Do not include dollar signs ($), commas (,), decimal points (.), or negative. Mail this form and your check or money. Use 100% of the 2025 estimated total tax. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to pay.

2022 California Estimated Tax Worksheet

Do not include dollar signs ($), commas (,), decimal points (.), or negative. Use 100% of the 2025 estimated total tax. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use the 540 2ez tax tables on the tax calculator, tables, and rates page. Estimated tax is used to.

California Estimated Tax Worksheet 2024

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use the 540 2ez tax tables on the tax calculator, tables, and rates page. Do not include dollar signs ($), commas (,), decimal points (.), or negative. Mail this form and your check or money. Use 100% of the 2025.

2023 California Estimated Tax Worksheet Tax Computation Work

Estimated tax is used to pay. Mail this form and your check or money. Use the 540 2ez tax tables on the tax calculator, tables, and rates page. Use 100% of the 2025 estimated total tax. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Estimated Tax Payments 2022 California Latest News Update

Use the 540 2ez tax tables on the tax calculator, tables, and rates page. Mail this form and your check or money. Do not include dollar signs ($), commas (,), decimal points (.), or negative. Use 100% of the 2025 estimated total tax. Estimated tax is used to pay.

Estimated Tax Is Used To Pay.

Do not include dollar signs ($), commas (,), decimal points (.), or negative. Mail this form and your check or money. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use the 540 2ez tax tables on the tax calculator, tables, and rates page.